Analog Devices Inc., Elliott Wave Technical Analysis

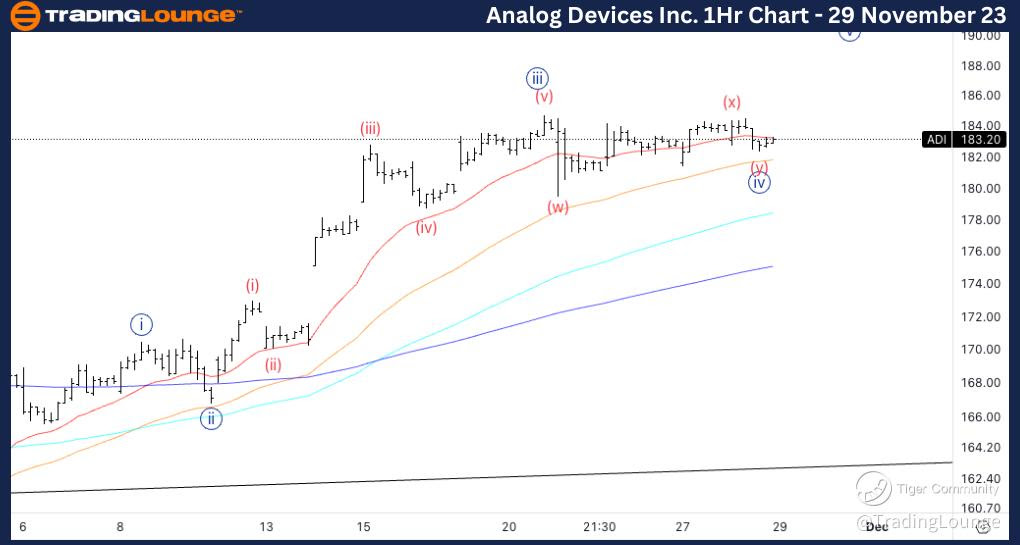

Analog Devices Inc., (ADI:NASDAQ): 4h Chart 29 November 23

ADI Stock Market Analysis: We have been looking for upside on Analog Devices as 183$ as been acting as tested support for some days now. Looking for continuation higher into Minor Group 2 and potentially all the way up into 200$.

ADI Elliott Wave Count: Wave {iv} of 1.

ADI Technical Indicators: Below 20EMA.

ADI Trading Strategy: Looking for longs into wave {v}.

TradingLounge Analyst: Alessio Barretta

Source: Tradinglounge.com get trial here!

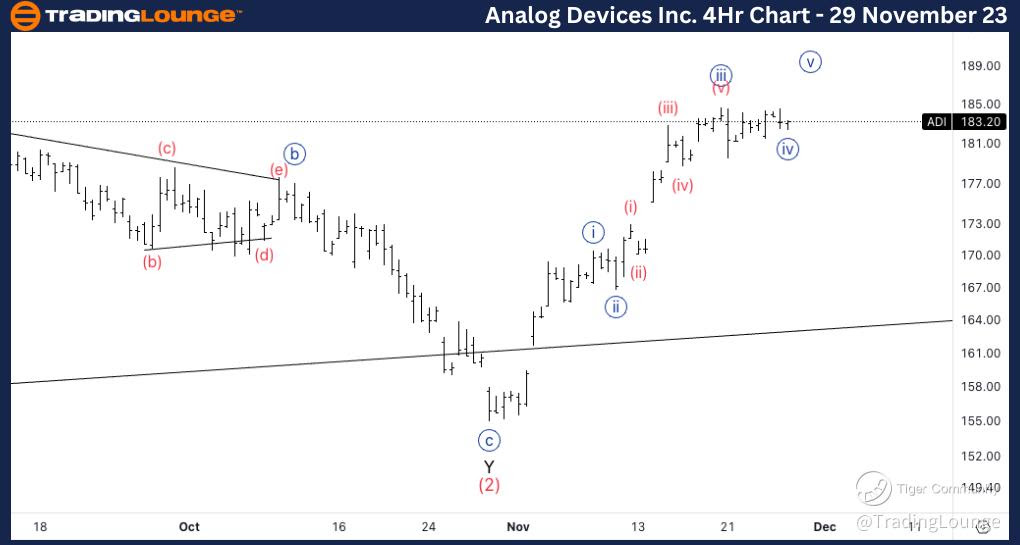

Analog Devices Inc., ADI: 1-hour Chart 29 November 23

Analog Devices Inc., Elliott Wave Technical Analysis

ADI Stock Market Analysis: Looking for some sort of complex correction into wave {iv} as we are moving sideways, alternating with the corresponding wave {ii}.

ADI Elliott Wave count: Wave (y) of {iv}.

ADI Technical Indicators: Above all averages.

ADI Trading Strategy: Looking for longs into wave {v}.